Tips for Investment Banking Marketing: Beyond the Tombstone

It’s all over. The ink is dry, the signatures are in place, and the deal is done. Now what? As an investment bank or M&A advisory firm, your job isn’t done just because the transaction is complete. In fact, it’s only just beginning (when it comes to new business). You need to keep marketing the deal to your target audience long after it closes.

Most M&A firms have an idea of what should happen immediately after a closed transaction, from issuing a press release to designing a branded “tombstone” as a trophy representing your involvement in the deal, whether sell-side or buy-side.

But if you want to continue proving domain expertise and attracting your ideal company, you’ll have to go beyond the basics. This post will describe the steps you should take to maximize your investment banking marketing efforts even long after a transaction closes.

RELATED: It’s Time for Investment Banking Marketing to Step Up its Game

Develop Documentation

Throughout the transaction and as the deal closes, your goal should be to document the challenges involved in the deal—from positioning to finding an ideal buyer to negotiation—as well as how you developed solutions along the way to some of these challenges.

This serves several purposes:

- Providing an internal resource to look back on for similar transactions.

- Acting as a training tool for new hires.

- Helping you to further define brand personas for marketing.

- Making it easier to write a press release quickly.

- Serving as a reference to develop additional marketing content for a specific industry or transaction type.

Create a Content Calendar

By documenting the key details of a deal, you’ll have access to a wealth of content to repurpose in other formats. You can use this content to create:

- In-depth articles

- Short blog posts

- Case studies

- Infographics

- Video interviews with key stakeholders

- Podcasts

You’ll be able to keep leveraging what you’ve learned and your team’s expertise in your marketing long after the tombstone has been forgotten.

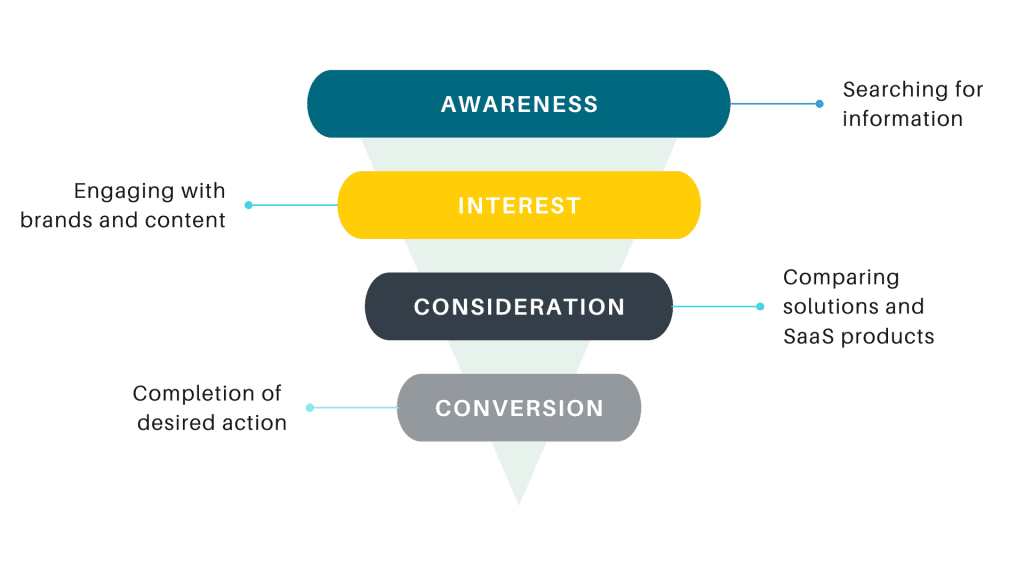

Finding the right balance of content involves understanding what we call the marketing funnel. Check out the image below and you’ll see that most of the traffic to your website (the widest part of the funnel – awareness) is likely to be people who are just curious. They’re not ready to meet with your team just yet, so you want to provide them with helpful, informative content to get them ready.

Then, as they move down the funnel (interest), you can provide more detailed information about your services. Finally, when they’re ready to buy (consideration and conversion), you want to make sure you’re providing content that will help them choose your firm (like case studies and testimonials).

Finding a Focus

The marketing funnel is a great way to think about the different types of content you should be creating, but how do you determine a topic?

Thanks to your deal documentation, you’ve got a lot of great information to work with. A major part of post-transaction content marketing in investment banking is figuring out how to use it in as many ways as possible. The first step is identifying the main challenge your client faced and how you helped them overcome it. From there, you can create top-of-funnel content like:

- A blog post documenting the challenge and solution.

- An article about specific challenges this industry faces in M&A, using the closed transaction as a case study.

- A video summarizing the key challenges and how similar companies can overcome them.

- Social media content summarizing a small portion of the transaction story.

- A gated webinar (meaning people have to sign up via a form) walking people through the deal details.

You may have to anonymize names and companies in some cases, but your experience is just as valued and valuable without name dropping.

Additionally, you can develop middle- and bottom-of-funnel content that proves your expertise and experience to prospective clients:

- A case study or white paper that goes into specific details and numbers.

- An infographic highlighting statistics from the deal.

- Highlighting this deal and others in marketing email workflows and sales email sequences.

To Tombstone or Not to Tombstone?

A press release after a closed transaction is typically a given. It’s a win-win-win for the buy-side advisor, sell-side advisor, and the companies involved.

But with all these ways to build content and repurpose your press releases, you may wonder if the old school tombstone method is still a valid way to display your successes.

For the most part, the long-held standard of creating, posting, and distributing a tombstone (often designed by a graphic designer and easily duplicated for each deal) is not slowing down. However, many companies are trying new and unique ways to display a tombstone, from video announcements on social media to interactive tombstones designed as infographics.

In addition, tombstones are displayed on various channels. Rather than sending tombstones to a stale audience of existing contacts, you might expand tombstone placement on relevant blogs and web pages, social media posts, and cold lead workflows.

Your Partner in Post-Transaction Investment Banking Marketing

With over 4,000 investment banks in the US and counting, what you do to stand out today can make a huge difference to your growth in the future. By expanding your online presence beyond current contacts, you tap into new networks and position your brand for continued success.

The right investment banking marketing firm will help you take a strategic approach to post-transaction investment banking marketing. From strategy to implementation, a fractional marketing team can help you to plan and create content that drives results.

Contact Marketri to learn more about our fractional marketing model for marketing scalability and growth. Schedule your call with CEO Deb Andrews today.